When it comes to getting an investment property loan, there are two main options that you, as an investor, may consider – a DSCR (debt service coverage ratio) loan or a conventional loan. This brings us to the frequently contested subject of choosing between a DSCR loan vs conventional loan. These loan products have unique features and serve different purposes in real estate financing.

I will discuss these two lending options in detail in the following sections. I’ll dive into what they are, how they work, and scenarios where one might be a better choice. Let’s dive in!

What is a DSCR Loan?

A DSCR, or Debt Service Coverage Ratio loan, is a type of loan particularly tailored for real estate investors. Rather than focusing on your income, and employment status, underwriters base their lending decision on the income produced by the investment property. The relationship between the income generated by a property and its potential mortgage payment (debt) is known as a Debt Service Coverage Ratio.

To calculate the Debt Service Coverage Ratio, you simply divide the property’s net operating income by the debt service (the total amount of loan payments, including principal and interest).

Why does this matter? Lenders use this ratio to assess whether the property will generate enough income to repay the loan.

A debt service coverage ratio (DSCR) of less than 1 means that the property’s income is insufficient to cover its debt. A DSCR of at least 1 means the property’s income is equal to its debt service. A DSCR greater than 1 indicates the property is generating sufficient income to cover its debts, a green flag for lenders!

DSCR loans often come into play in real estate investing when an investor is purchasing a rental property or refinancing an existing investment property loan. They are also a common choice for investors who own multiple properties or have a complex income structure that might not fit into the conventional mortgage loan mold.

Next, we will discuss conventional loans and how they differ from DSCR loans.

What is a Conventional Mortgage Loan?

Conventional loans are mortgages that are not insured by the federal government. They are typically issued by private lenders such as banks, credit unions, and mortgage companies. They rely heavily on your financial situation, including your credit score, income, debt-to-income ratio, and the property’s loan-to-value ratio.

To qualify for a conventional loan for an investment property, you generally need to have a good-to-excellent credit score (minimum score of 620), a steady income, at least six months of reserves post-closing, and a debt-to-income ratio of 45% or less. Some lenders might be more lenient with these requirements if other compensating factors are present, but these are good benchmarks to have in mind.

Regarding financing an investment property, conventional loans can be a great fit for investors with a solid financial profile investing in single-family homes or small multi-family properties (2-4 units). They can also be a good choice for a buy-and-hold investor who plans to hold onto a property for the long term, as the interest rates tend to be fixed and are more competitive than the interest rates associated with a DSCR loan.

In the next section, we’ll put DSCR and conventional loans side-by-side to compare their key differences.

DSCR Loan vs Conventional Loan: Key Differences

Now that we’ve individually examined DSCR and conventional loans, it’s time to put them head-to-head. Let’s break down the key differences between these two lending options.

Qualification Requirements:

The main difference lies in what lenders consider when deciding whether or not to approve the loan. As previously mentioned, DSCR loans focus primarily on the investment property’s income, while conventional loans look at your financial situation. Let’s take a deeper look at these two loan offerings:

DSCR Loan

Typical DSCR Loan Qualification Criteria

| Minimum Credit Score | 620 |

| Documentation | Bank Statement, Lease Agreement, Property Income and Expenses. |

| Appraisal | An appraisal is required |

| Reserve Requirements | If required, will vary from lender to lender |

| Debt-to-Income Ratio | Not considered |

| Minimum DSCR | 0.80. However, a 1.25 or greater will result in better loan terms. |

Conventional Loan

Typical Conventional Loan Qualification Criteria

| Minimum Credit Score | 620 |

| Documentation | W2, Paystubs, Income Tax Returns, Bank Statements. |

| Appraisal | An appraisal is required |

| Reserve Requirements | At a minimum, six months reserves |

| Debt-to-Income Ratio | Maximum of 43-45% |

| Minimum DSCR | Not applicable |

In a nutshell, if you have a highly profitable property but a less-than-perfect personal financial profile, a DSCR loan may be more attainable. Conversely, a conventional loan might be more within reach if you have a strong personal financial situation but a property that could perform better income-wise.

However, it is worth noting that compared to a conventional loan, a DSCR loan can have qualification standards that vary (by a lot) from lender to lender. This is because DSCR loans are non-QM loans, so there are no hard and fast rules regarding standards for qualification or approval.

Next, let’s look at the differences regarding maximum loan amounts when comparing a DSCR loan and a conventional loan.

Loan Amounts:

Before we dive into the differences in maximum loan amounts between a DSCR loan and a Conventional Loan, here’s a quick primer on how loan amounts are calculated.

Loan-to-Value (LTV) Formula

Lenders use a ratio known as “Loan-to-Value” to determine your loan amount. The formula to calculate your loan amount is the appraised value multiplied by the lender’s marketed LTV ratio:

MA = APV x LTV ratio

Where:

APV = Appraised Value

MA = Mortgage Amount

Let’s put the above formula into a real-life example. Let’s say the lender you choose offers you an investment property loan with a 75% loan-to-value ratio. The lender orders an appraisal, and the value comes back at $200,000. So we have $200,000 as our APV (appraised value) and 75% as our LTV ratio. To determine the loan amount, we would plug these numbers into the formula above:

MA = $200,000 x 75%

MA = $150,000

In this scenario, our mortgage loan amount would be $150,000.

DSCR Loan:

With a DSCR loan, you can typically get a loan with a higher loan-to-value ratio than a conventional mortgage. Generally, the highest LTV ratio for a DSCR loan is 80%. However, as mentioned before, since standards and qualifications can vary from lender to lender, the exact criteria you would need to meet to get a loan with an 80% loan-to-value ratio will differ from lender to lender.

Credit Tier Modifications

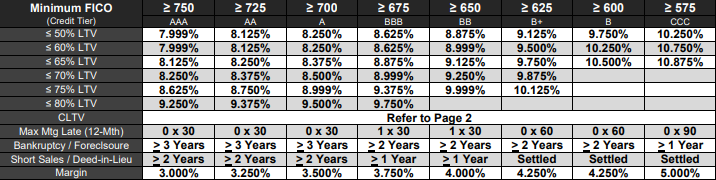

Below is an example of a rate sheet for a DSCR lender on our panel that shows an example of how the LTV and interest rates may be affected depending on your credit score:

The example above shows a 1% difference in the interest rate between a borrower opting for a DSCR loan at a 70% loan-to-value and an 80% loan-to-value with a credit score of 675 or higher.

Additionally, if we look over to the right, if you had a credit score less than 650, the max loan-to-value available would be 75%. So while achieving a higher loan amount is possible with a DSCR loan, with this particular lender, it does come at the price of an increased interest rate and is limited to borrowers with a credit score of 675 or above.

Loan-to-Value Modifications

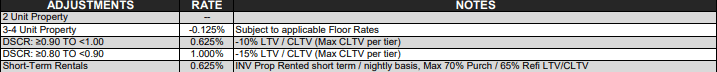

The property type or even the DSCR ratio may also affect the maximum loan-to-value ratio on a DSCR loan:

In the example above, if the property you were financing were a short-term rental (Airbnb), even if the borrower had an excellent credit score of 750, the maximum loan-to-value ratio the lender would extend to the borrower would be 70% of the appraised value for a purchase or 65% for a cash-out refinance.

Also, with this lender, if the calculated DSCR ratio for your property were less than 0.90, you would have to subtract 15% from the quoted LTV amounts in the first chart pictured.

So, as an example, let’s say that your property had a calculated DSCR of 0.85, and as a borrower, you had a 750 credit score. The max loan-to-value permitted for this credit tier is 80% (as pictured in the interest rate chart). However, since your property only had a DSCR of 0.85, we would need to reduce the loan-to-value ratio by 15%, making the max loan amount this lender would offer 65% (80% LTV minus 15% LTV adjustment) of the appraised value.

While there is the possibility of leveraging more of the appraised value of your property with a DSCR loan, some lenders may have overlays that will modify the total loan amount you may be approved for. It’s important to note that not all DSCR lenders are as restrictive as the example shown in this section.

Now, let’s get into how loan amounts for conventional loans are determined.

Conventional Loan:

With a conventional loan, loan amounts are standardized. This is because lenders that underwrite conventional loans do so according to the Fannie Mae or Freddie Mac selling guide.

With a conventional loan, as per the Fannie Mae Eligibility Matrix, three types of transactions can take place, which will determine your maximum loan amount:

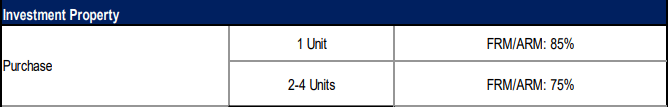

Purchase

With a purchase of an investment property using conventional financing, the max loan amount for a single-family property would be based on an 85% loan-to-value ratio. This translates to a 15% down payment.

If you are using conventional financing for a 2-4 family property, the maximum loan amount would be based on a 75% loan-to-value ratio. This translates to a 25% down payment.

However, keep in mind that some conventional mortgage lenders will apply a more restrictive overlay on the max loan-to-value ratio, requiring at least a 25% down payment for an investment property, regardless of how many units.

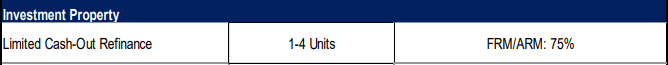

Limited Cash-Out Refinance

A limited cash-out refinance is defined as a refinance that covers the repayment of the original mortgage, closing costs, and other liens with no more than $2,000 or 2% (whichever is less) of the new loan amount going to the borrower in the form of cash.

In this scenario, the maximum loan amount permitted would equal 75% of the appraised value as long as the cash to the borrower does not exceed the lesser of $2,000 or 2% of the loan amount.

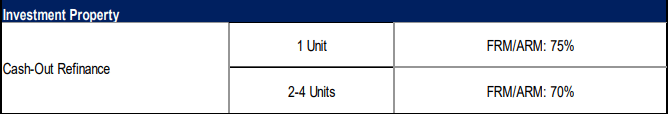

Cash-Out Refinance

With a cash-out refinance, the maximum loan amount on a single-family investment property is based on 75% of the appraised value.

If the investment property has 2-4 units, the maximum loan amount a conventional lender will approve you for would be based on 70% of the appraised value.

While a DSCR loan can offer you the opportunity to borrow more of the appraised value of your property, the standards and qualifications can differ depending on the lender, as there is no regulatory oversight with DSCR loan underwriting.

Now, let’s explore other significant differences between DSCR and conventional loans.

Asset Protection:

Regarding asset protection and maintaining an anonymous profile, you can obtain a DSCR loan and hold title as an LLC entity instead of owning the property under your name. With a conventional loan, you must take ownership of the property under your personal name.

Financial Implications:

The two loan types can also have different economic implications. Conventional loans often come with competitive interest rates, especially for borrowers with excellent credit.

However, you must meet the strict qualification requirements of conventional loan underwriting to avoid higher interest rates or even loan denial.

DSCR loans, while potentially easier to qualify for, generally come with higher interest rates due to the perceived increased risk for the lender.

Application Process:

The application process can differ as well. For DSCR loans, lenders will want to see detailed financial records of the property, including rental income and expenses. On the other hand, conventional loan applications typically require extensive documentation of your finances, including tax returns, W-2s, pay stubs, and bank statements.

In the upcoming section, we’ll look at specific scenarios where one loan might be a better choice.

DSCR Loan vs Conventional Loan: Use Cases

With the basics and differences between DSCR and conventional loans clarified, it’s time to look into real-world scenarios to provide a clearer perspective on when one loan product may be more advantageous.

A. Best Use Cases for DSCR Loans

- Profitable Properties with Lower Personal Income: Suppose you are a real estate investor whose primary income is not high but who owns a property that generates significant rental income. In such a scenario, a DSCR loan could be a fantastic fit, as the lending decision is primarily based on the property’s income rather than yours.

- Entity Owned Properties: If you’re an investor who took ownership of your property using an entity such as an LLC (Limited Liability Company), using a DSCR loan will ensure that you can continue holding the property in an entity affording you asset protection and the benefit of anonymity.

- Self-Employed or Irregular Income: For self-employed individuals or those with an irregular income source but profitable rental properties, DSCR loans could offer a more accessible financing solution.

B. Best Use Cases for Conventional Loans

- Strong Personal Financial Profile: If you have a strong credit score, steady income from active employment, and a healthy debt-to-income ratio, a conventional loan could be a smart option. You’ll likely secure the best interest rates.

- Single-Family Homes or Small Multi-Family Properties: Conventional loans can be a great fit if you invest in single-family homes or small multi-family properties. These loans often have more attractive rates and terms for these properties.

- Long-Term Buy-and-Hold Strategy: If you’re a buy-and-hold investor planning to hold onto a property for an extended period, conventional loans’ generally lower interest rates can save you money in the long run.

Every investor’s situation is unique, and it’s essential to consider your investment strategy and financial circumstances when choosing a loan.

The Wrap Up

Choosing between a DSCR loan and a conventional loan boils down to your unique investment strategy, property type, and personal financial circumstances. DSCR loans, focusing on the property’s income, can be a lifeline for investors with profitable properties yet complex, unique financial situations, making them ideal for multi-unit properties or those with irregular income streams. On the contrary, conventional loans, anchored in the borrower’s personal finances, benefit those with firm financial profiles, primarily when investing in single-family homes or smaller multi-family properties.

Ultimately, the crux of the DSCR loan vs conventional loan debate is not about identifying a universally superior loan type. Instead, it’s about discerning which option aligns best with your individual circumstances and investment ambitions.

Got more questions or thoughts to share about DSCR loans vs conventional loans? Don’t hesitate to reach out to us. We love hearing from our readers. Plus, sharing is caring, so if you found this information valuable, why not share it with your fellow investors?