When it comes to real estate loans, there’s a recurring term that stands out: the “loan-to-value ratio” or “LTV ratio.” If you’re considering buying a property, this is one concept you’ll want to master.

So, let’s get to it. Let’s say you’re eyeing a house priced at $250,000, and you approach a bank for a loan of $200,000. To find the LTV ratio, divide the loan amount ($200,000) by the property’s price ($250,000). This gives us 0.8, or an 80% LTV when converted to a percentage.

Why does this number matter? Well, it helps banks gauge the risk they’re taking. A high LTV ratio indicates that you’re borrowing a larger chunk of the property’s value, which can make lenders a tad nervous. On the flip side, a lower LTV ratio suggests you’re putting more of your own money into the property, making it a safer bet for lenders.

In the upcoming sections, we’ll explore the meaning of LTV in real estate, the formula to calculate the loan-to-value, how LTV compares to combined loan-to-value & loan-to-cost, max LTV ratios based on the loan type, and how the loan-to-value ratio can impact your investment strategy. Let’s get started!

What is the Meaning of LTV in Real Estate?

To put it plainly, the LTV ratio is a way to show the relationship between the amount of money you’re borrowing and the total value of the property you want to buy. If you see an LTV ratio of 70%, for example, it means you’re borrowing 70% of the property’s value, and the remaining 30% is what you’re putting as your initial down payment.

Why is this number so significant? In the eyes of a lender, the LTV ratio is like a thermometer measuring the risk of the loan. If the ratio is high, it signals to the bank that you’re relying heavily on borrowed money to make the purchase. This might make them cautious since if property value drops, they might only recover part of the loan amount if they had to sell the property in a foreclosure scenario. On the other hand, a lower LTV indicates you have a bigger stake in the property, reducing the risk for the lender.

In simpler terms, think of the LTV ratio as a seesaw. On one side, you have the loan amount, and on the other, the property value equity. The balance between these two determines how risky the deal might seem to a bank or lender.

As we venture further into real estate investing, understanding this balance and the concept of the LTV ratio can greatly influence your financing decisions and overall investment success.

Now, let’s get into how to calculate your loan-to-value ratio.

How to Calculate Your LTV Ratio?

The Loan-to-Value (LTV) ratio formula is straightforward:

LTV Ratio = MA divided by APV

Where:

MA = Mortgage Amount

APV = Appraised Property Value

Steps to Calculate LTV:

Determine the Loan Amount:

This is the amount of money you want to borrow or have already borrowed to purchase the property. For instance, if you’re applying for a mortgage of $180,000, that’s your loan amount.

Find Out the Property’s Appraised Value:

This is sometimes different from the sale price. It’s the value assigned to the property by a professional appraiser, who considers factors like location, condition, and comparable property sales in the area. Let’s say the appraised value of your home is $225,000.

Apply the formula using our example:

LTV Ratio = $180,000 divided by $225,000 = 0.80 or 80%

LTV Ratio = 80%

So, if you’ve borrowed $180,000 for a property appraised at $225,000, your LTV ratio is 80%.

Steps to Calculate Max Loan Amount

But what if you already know the appraised value and LTV ratio, how can we determine the loan amount? We would modify the formula:

MA = APV times LTV Ratio

Where:

MA = Mortgage Amount

APV = Appraised Property Value

So if the loan-to-value ratio is 75% and the appraised value of the home is $150,000:

MA = $150,000 times 75%

MA = $112,500

The max loan amount the lender would approve is, $112,500

Why This Matters:

Understanding your LTV can influence various aspects of your real estate journey. A higher LTV might mean higher mortgage rates or even stricter loan approval criteria for investment properties, while a lower LTV generally puts you in a favorable position with lenders.

But, although a higher LTV ratio may lead to higher interest rates, it is worth noting that, with a loan that has a higher loan-to-value ratio, you will be required to invest less of your own cash, which can increase your total cash-on-cash return and leave you with more capital to acquire more investment properties using leverage.

Loan-to-Value (LTV) vs. Combined Loan-to-Value (CLTV) vs. Loan-to-Cost (LTC)

Real estate financing is peppered with numerous acronyms and jargon. Three terms that often arise, especially in the context of investment properties, are LTV, CLTV, and LTC. Here’s a concise breakdown to help you differentiate them:

Loan-to-Value (LTV):

- Definition: The ratio of the primary mortgage loan to the property’s appraised value.

- Formula: LTV = (Primary Mortgage Loan ÷ Appraised Property Value) x 100

- Purpose: LTV provides lenders with a snapshot of how much equity you have in the property relative to the loan. A lower LTV generally indicates a lower risk for lenders.

Combined Loan-to-Value (CLTV):

- Definition: This ratio considers all loans secured against a property, not just the primary one.

- Formula: CLTV = (Total of All Loans on the Property ÷ Appraised Property Value) x 100

- Purpose: CLTV gives lenders a comprehensive view of all encumbrances on a property. For instance, if you have a primary mortgage and a home equity loan, the CLTV will factor in both.

Loan-to-Cost (LTC):

- Definition: The ratio that compares the loan amount to the property project’s total cost. This is particularly relevant for construction or renovation projects.

- Formula: LTC = (Loan Amount ÷ Total Project Cost) x 100

- Purpose: The LTC provides insights for lenders into how much of a project’s cost is financed versus how much the borrower invests directly. For example, the LTC would weigh the loan against the combined land purchase costs, materials, labor, and other associated costs in a construction project.

Why These Ratios Matter:

All three ratios serve a fundamental purpose: to provide lenders with a clear understanding of the risk they’re assuming. While the LTV and CLTV focus on the property’s value, the LTC zeroes in on the total cost of a project, making it especially significant for developers or investors undertaking a property that will require substantial rehabilitation.

Knowing these distinctions and how each ratio impacts financing decisions is fundamental for navigating the seas of real estate financing.

Now, let’s get into how lenders use loan-to-value ratios.

How Lenders Use Your LTV Ratio

The Loan-to-Value (LTV) ratio isn’t just a number; it’s a powerful tool for lenders, enabling them to gauge the risk they’re taking on when they grant you a loan. But how exactly do lenders interpret and use this ratio? Let’s break it down.

Assessing Risk:

At its core, the LTV ratio is a risk metric. A higher LTV (say 90% or above) means you’re borrowing a large chunk of the property’s value. For lenders, this can be seen as risky. Why? If you default on your payments and they need to sell the property, they might recoup only part of the loan amount, especially if property values drop.

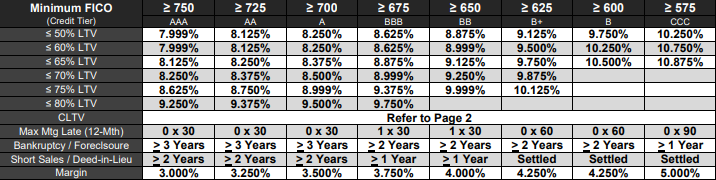

Determining Interest Rates:

Typically, a higher LTV can lead to a higher interest rate, as lenders may want compensation for their perceived increased risk. Conversely, a lower LTV might secure you a more favorable rate, saving you money in the long run. Below is a rate sheet from a lender on our panel that demonstrates how LTV can impact the interest rate:

Mortgage Insurance Requirements:

For loans with high LTV ratios, lenders often require borrowers to purchase Private Mortgage Insurance (PMI) or pay Mortgage Insurance Premiums (MIP) if using FHA financing. This insurance protects lenders if a borrower defaults on their loan. If your LTV ratio exceeds a certain threshold, often 80%, you might have to factor PMI or MIP costs into your budget.

Loan Approval or Denial:

While the LTV ratio is just one of many factors lenders consider, it can play a significant role in the approval process. An LTV that’s too high might result in a denied application, as it might surpass the lender’s accepted risk level. The illustration shown earlier shows how a borrower’s credit score can impact the max LTV they can qualify for.

Refinancing Considerations:

If you’re looking into refinancing your home, lenders will review your LTV ratio again. A lower LTV can offer more refinancing options and potentially better rates.

So while the LTV ratio is certainly not the only factor lenders look at (credit scores, income, employment history, and debt-to-income ratios also play roles), it’s undeniably a pivotal one.

What is a Good LTV for a Mortgage?

The answer is more than one-size-fits-all, but understanding the general guidelines can be incredibly helpful.

Typical LTV Ranges:

80% or Below:

This is often considered the “gold standard” for many lenders. Why? Because at this level or lower, borrowers typically don’t need to pay Private Mortgage Insurance (PMI). It indicates a substantial down payment, reducing the lender’s risk. With most investment loan products like DSCR loans, a loan-to-value ratio of 80% is typically the highest an investor can secure on a purchase or cash-out refinance.

Above 80% to 90%:

This range is quite common, especially for first-time homebuyers who might not have the funds for a larger down payment. However, these LTV ratios often come with the requirement for PMI, which protects the lender should the borrower default.

Above 90%:

These can be considered riskier for lenders, often leading to higher interest rates or stricter terms. They usually require PMI or MIP.

Factors Influencing a ‘Good’ LTV:

Property Type:

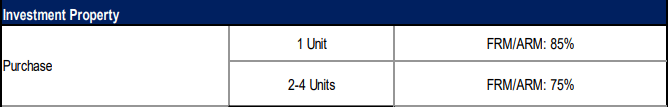

Investment properties might have stricter LTV requirements than primary residences since they can be seen as riskier. Below is an example of the maximum loan-to-value ratios Fannie Mae will allow on an investment property purchase:

Credit Score:

A strong credit score can sometimes qualify you for a higher LTV, as it indicates financial responsibility and reliability.

Economic Climate:

In a booming housing market, lenders (particularly non-QM lenders) might be more lenient with LTV ratios. Conversely, during economic downturns, they might be stricter.

Benefits of a Lower LTV:

Better Interest Rates:

Lower LTVs can secure more favorable interest rates.

Higher Cash-Flow:

With regard to investment properties, the lower your LTV ratio, the higher the cash flow you can expect your asset to produce.

No PMI or MIP:

As mentioned, LTVs of 80% or lower usually sidestep PMI, saving borrowers money.

Working Towards a Good LTV:

Increase Down Payment:

The more you can put down upfront, the better your LTV ratio.

Consider a Smaller Loan:

You aren’t required to take a loan at the lender’s maximum loan-to-value ratio. I personally had a situation where a property I was completing a cash-out refinance for appraised at $160,000; the lender’s max LTV was 80%, so technically, I could have cashed out $128,000. I opted to recoup my capital investment of $75,000 to repeat the process elsewhere.

The theory of a “good” LTV can vary based on individual circumstances and market conditions; aiming for a lower LTV is generally advantageous. So now, let’s look at why lenders look at loan-to-value ratios.

Why Lenders Look at LTV Ratios

Understanding the Loan-to-Value (LTV) ratio is one thing, but grasping why it’s such a crucial metric for lenders can offer even deeper insights into the mortgage process. Here’s why the LTV is a cornerstone in a lender’s decision-making process:

Risk Assessment:

- Indicator of Financial Commitment: A lower LTV suggests that the borrower has more of their own money invested in the property. This typically means they have more at stake and may be less likely to default on their loan.

- Recovery of Funds: In the unfortunate event of foreclosure, a lower LTV ratio can help ensure the lender recovers their money. For example, if a borrower defaults on a property with an LTV of 70%, selling the property should allow the lender to recover their funds since they’ve only loaned 70% of the property’s value.

Determination of Loan Terms:

- Interest Rates: LTV ratios can play a significant role in the interest rates offered. Higher LTVs might lead to higher interest rates due to the perceived risk.

- Loan Duration and Terms: Lenders might offer different term lengths or loan conditions based on the LTV ratio.

PMI or MIP Requirements:

- Protection Against Default: As previously mentioned, when LTVs exceed 80%, lenders typically require Private Mortgage Insurance (PMI). This insurance protects the lender if the borrower fails to make their payments.

Evaluating Property Market Fluctuations:

- Property Value Safety Net: Property values can fluctuate. If a lender has loaned money at a high LTV ratio and property values decrease, the borrower could end up owing more than the property is worth, increasing the risk for both parties. Short sales are anything but short!

The LTV ratio is not just a number; it’s a lens through which lenders view the risk and potential of a loan. It helps lenders gauge the safety of their investments and determine appropriate loan terms. Now, let’s explore the typical max loan-to-value ratios by loan type.

Max LTV Ratios by Loan Type

The maximum Loan-to-Value (LTV) ratio allowed often varies based on the type of loan you’re seeking. Different loan programs have distinct guidelines determining how much they will lend relative to the property’s value. Let’s dive into some common loan types and their typical maximum LTV ratios:

DSCR Loan (Debt Service Coverage Ratio Loan):

- What It Is: DSCR loans are often used for investment properties. The Debt Service Coverage Ratio measures an entity’s ability to cover its debt obligations with its net operating income.

- Max LTV: Typically, DSCR loans have a maximum LTV of around 75% to 80%, but this can vary based on the lender and the specifics of the property or deal.

Conventional Loan:

- What It Is: A conventional loan isn’t backed by a government agency and is the most common type of mortgage.

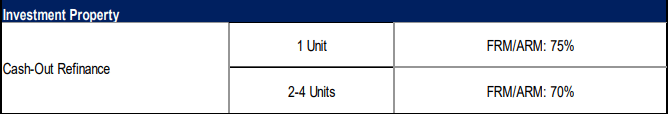

- Max LTV: You can often find maximum LTV ratios of up to 97% for primary residences. However, it’s usually reduced for investment properties, often to around 85%. The image above illustrates the maximum LTV’s for a conventional cash-out refinance on an investment property.

FHA Loan (Federal Housing Administration Loan):

- What It Is: FHA loans are backed by the federal government and are designed to help lower-income and first-time homebuyers.

- Max LTV: FHA loans allow for a high LTV, usually up to 96.5% for primary residences. Investment properties are not eligible for FHA loans. In this case, the FHA refers to non-owner-occupied homes as investment properties. If you intend on living in one of the units of a multi-family home (2-4 units), you can use an FHA loan to deploy the famous “house-hacking” strategy.

VA Loan (Veterans Affairs Loan):

- What It Is: VA loans are available for eligible veterans, active-duty service members, and certain National Guard and Reserves members.

- Max LTV: The VA loan program can allow an LTV ratio of up to 100% for primary residences, meaning eligible borrowers can finance the entire purchase price.

USDA Loan (United States Department of Agriculture Loan):

- What It Is: These loans are designed for rural homebuyers and are backed by the US Department of Agriculture.

- Max LTV: Like VA loans, USDA loans can also offer a 100% LTV for eligible borrowers, allowing them to finance the full property value.

Different loan types cater to various needs and situations, each with its LTV guidelines. But how can these ratios affect your particular investment strategy? Let’s find out.

Impact of LTV Ratios on Investment Strategies

The Loan-to-Value (LTV) ratio isn’t just a metric for lenders. For savvy real estate investors, understanding how the LTV ratio interacts with various investment strategies can offer crucial insights and shape your strategy. Let’s explore some popular real estate investment strategies and the role LTV ratios play in each:

BRRRR (Buy, Rehab, Rent, Refinance, Repeat):

- How It Works: Investors purchase a property, renovate it, rent it out to tenants, refinance to pull out equity (if done correctly, you should have recouped your entire capital investment), and then repeat the process with another property.

- LTV Implications: After rehabbing the property, its value ideally increases. When refinancing, a lender will assess the new value. A favorable LTV now based on the after-repair value can lead to recouping your capital investment and recycling it for the next investment.

Fix and Flip:

- How It Works: Investors buy properties, renovate them quickly, and then sell them for a profit.

- LTV Implications: For fix and flip loans, lenders often offer a higher LTV on the purchase price but a lower LTV for the renovation costs. An investor needs to ensure they have enough capital to cover the purchase and rehab.

Buy and Hold:

- How It Works: Investors purchase properties and hold onto them long-term, generating income through renting.

- LTV Implications: With a buy-and-hold strategy, securing a mortgage with a favorable LTV can mean lower monthly payments, increasing the monthly cash flow from the rental property. Over time, as the principal is paid down and property value potentially rises, the LTV decreases, which can be favorable for refinancing or leveraging equity in the future.

The LTV ratio isn’t a static figure to be glanced over. Its implications ripple through investment strategies, affecting potential returns, risk levels, and the ability to leverage equity. By being astute about how LTV ratios interact with their chosen investment strategy, you can make more informed decisions, better manage your risks, and optimize your return on investment.

The Wrap Up

The Loan-to-Value (LTV) ratio, often a simple percentage at first glance, carries significant weight in real estate finance. From shaping a lender’s perception of risk to determining mortgage insurance requirements and influencing investment strategies, its ripple effects are felt at every stage of the buying, selling, and investing process.

For the real estate investor:

- Understanding how different loan types accommodate LTV ratios can shape your approach to financing.

- Tailoring investment strategies with an eye on LTV can help optimize returns and manage risks.

- Recognizing the difference between LTV, combined LTV, and loan-to-cost can be the difference between a good investment decision and a great one.

The LTV ratio serves as a compass, guiding lenders and investors. It’s an indispensable tool for assessing risk and making strategic decisions in the dynamic landscape of real estate.

Whether you’re taking your first steps in property investment or have a vast portfolio, keeping the LTV ratio at the forefront of your financial decisions will stand you in good stead. It’s not just a number—it’s a pathway to informed, strategic, and successful real estate endeavors.