Are you considering a cash-out refinance for your investment property but need clarification on the cash-out refinance seasoning requirements? You’re not alone. As an investor, it’s crucial to understand these requirements and their potential impact on your investment strategy.

Real estate investors often use the term “seasoning requirements” in their discussions. But what does it mean? Simply put, seasoning requirements refer to the length of time you need to hold your mortgage before you’re allowed to refinance. Specifically, when discussing cash-out refinance seasoning requirements, we’re referring to how long you must own the property before completing a cash-out refinance. The timeframe can vary depending on the type of loan and lending institution.

In this article, we’ll touch on everything you need to know about cash-out refinance seasoning requirements across various types of loans – DSCR, Conventional, Fannie Mae, Freddie Mac, FHA, and VA loans. Moreover, we’ll discuss the impact of these requirements on popular investment strategies like the BRRRR method. Let’s dive in!

What is a Cash-Out Refinance?

A cash-out refinance is a unique mortgage strategy homeowners and real estate investors use to tap into their property’s equity. In essence, a cash-out refinance allows you to replace your current mortgage with a new loan that’s larger than your existing loan balance. Typically, you would use this approach if your property’s value has increased significantly, either through forced appreciation or naturally over time.

This results in you receiving the difference in cash, hence the term “cash-out.” The process essentially transforms the equity “locked” in your property into liquid capital, which you can then use for a myriad of purposes – be it reinvestment, home improvements, debt consolidation, or any other financial need.

However, like any financial move, a cash-out refinance comes with its own set of requirements and considerations – one of the most significant being the cash-out refinance seasoning requirements. Understanding these will help you navigate and optimize the refinance process for your specific circumstances and investment goals.

DSCR Loan Cash Out Refinance Seasoning Requirements

Debt-Service Coverage Ratio (DSCR) loans have become increasingly popular among real estate investors. If you’re unfamiliar with DSCR loans, let’s clear the air. A DSCR loan is a type of investment property loan that bases its lending decision on the property’s cash flow. It’s an advantageous option for investors with a robust portfolio of income-producing properties whose personal income might not meet traditional lending requirements.

But what about the DSCR loan cash-out refinance seasoning requirements? Generally, lenders won’t require a seasoning period if you can demonstrate that you added value to the property through a substantial rehab. However, some more risk-averse lenders will require that you have owned the property for at least three to six months before you’re eligible for a cash-out refinance.

DSCR lenders will assess the property’s net operating income (NOI) to determine how much they will lend in a cash-out refinance scenario. The better your property performs, the more equity you can tap into.

Conventional Loan Cash Out Refinance Seasoning Requirements

Conventional loans, which are not insured or guaranteed by the federal government, typically have stricter cash-out refinance seasoning requirements than government-backed loans. These seasoning requirements protect lenders from borrowers who might abuse the refinancing system and ensure the borrower has a history of making timely payments on the property.

When it comes to conventional mortgage financing, Fannie Mae (the Federal National Mortgage Association) and Freddie Mac (the Federal Home Loan Mortgage Corporation) are government-sponsored enterprises that play a crucial role in the U.S. mortgage market. They buy and guarantee mortgages from lenders, allowing these institutions to free up funds to lend to more borrowers. In this way, Fannie Mae and Freddie Mac facilitate and stabilize the availability of conventional mortgages across the country. Now, let’s take a look at each of their cash-out refinance seasoning requirements.

Fannie Mae Cash Out Refinance Seasoning Requirements

When it comes to Fannie Mae’s cash-out refinance seasoning requirements, they are straightforward. As per the selling guide, there are two types of cash-out refinance seasoning requirement scenarios:

Paying Off an Existing Mortgage

If an existing first-lien mortgage is being paid off, it must be at least 12 months old at the time of refinance.

Delayed Financing Exception

If you do not have an existing mortgage, the seasoning requirement for a cash-out refinance is six months. However, the maximum cash you can pull out would be limited to your initial investment in purchasing the property plus the financing of closing costs, prepaid fees, and points on the new mortgage loan.

Using the delayed financing exception can be a great strategy to recoup your entire investment within a six-month time frame if you purchased a property that:

- didn’t need much work with cash and,

- was at a decent discount off market value.

To qualify for the delayed financing exception, you must have:

- purchased the home in an arms-length transaction,

- bought the property without mortgage financing and,

- have documented proof of your purchase funds source.

Freddie Mac Cash Out Refinance Seasoning Requirements

Much like Fannie Mae, Freddie Mac guidelines have seasoning requirements. When a cash-out refinance mortgage proceeds are used to pay off a first lien mortgage, the first lien mortgage being refinanced must be seasoned for at least 12 months.

For a home that is owned free and clear, the seasoning requirement is at least six months.

FHA Loan Cash Out Refinance Seasoning Requirements

If you’ve been investing in real estate using the house hacking strategy and have forced the appreciation of the property through value-add improvements. You might be happy to hear that you can initiate a cash-out refinance to recoup your initial investment too! With an FHA cash-out refinance, you can typically receive a maximum loan amount of 80% of the newly appraised value, which equals an 80% loan-to-value ratio.

Related: How to Read an Appraisal

The FHA will only permit cash-out refinances on owner-occupied properties. At least one borrower must have owned and occupied the property securing the cash-out refinance as their Principal Residence for 12 months prior to the date of an FHA case number assignment.

VA Loan Cash Out Refinance Seasoning Requirements

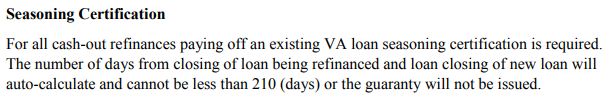

Veteran Affairs (VA) loans are unique lending products for service members, veterans, and eligible surviving spouses. Regarding cash-out refinance seasoning requirements for VA loans, the borrower must have made at least six consecutive monthly payments on the loan being refinanced. Additionally, at least 210 days must have passed since the first payment was made on the original loan.

Impact on the BRRRR Method

What is BRRRR?

The BRRRR method, which stands for Buy, Rehab, Rent, Refinance, Repeat, is a popular strategy among real estate investors seeking to expand their portfolios. The idea is to buy a property, make necessary renovations to increase its value, rent it out to generate income, then refinance to recoup the initial investment. After refinancing, the process starts again with a new property. This strategy can effectively leverage your capital, allowing for continuous growth of your real estate portfolio.

Seasoning Requirements and the BRRRR Method

When implementing the BRRRR method, understanding cash-out refinance seasoning requirements is crucial. These requirements can influence the ‘Refinance’ stage of your strategy. Depending on the type of loan you opt for, the seasoning period may require you to hold onto the property for six months to a year after the initial purchase or after the rehabilitation is complete. This timeframe can significantly impact how quickly you can move on to your next investment property. As a result, having a solid understanding of these requirements, coupled with careful planning and strategizing, is vital to making the most out of the BRRRR method and optimizing your real estate investment returns.

The Wrap Up

Cash-out refinance seasoning requirements may seem complex, but understanding them is an essential part of your toolkit as a real estate investor. These requirements vary based on the type of loan you’re dealing with – DSCR, Conventional, Fannie Mae, Freddie Mac, FHA, or VA – and each has unique conditions and timeframes that could impact your investment strategy.

When leveraging strategies like the BRRRR method, knowing these requirements can help you anticipate potential obstacles and keep your investment journey on track. It can guide you on how long you need to hold a property before moving on to the next one, influencing the pace and trajectory of your portfolio’s growth.

Whether you’re a seasoned investor or just starting, keeping cash-out refinance seasoning requirements at the forefront of your planning is crucial. These requirements could play a significant role in managing your investments. Always consider seeking personalized advice from a mortgage professional to navigate these requirements successfully and make the most informed decisions for your real estate portfolio. The world of real estate investing is yours to conquer – let knowledge be your guide!