Many people consider transparency a crucial aspect of any real estate transaction. Buyers and sellers rely on accurate information to make purchasing decisions and to negotiate fair deals. However, the rules can be cloudy in real estate non-disclosure states.

Real estate non-disclosure states operate under the premise that the selling price in a real estate transaction should not be disclosed as a public record. In this case, non-disclosure means that the sale prices of properties remain confidential and are not easily accessible to the general public.

What Information is Considered Non-Disclosure?

The idea behind non-disclosure laws is to protect the privacy of buyers and sellers. By keeping the selling price confidential, individuals can avoid potential scrutiny or predatory judgments based on their previously completed financial transactions. It also provides confidentiality for high-profile buyers or sellers who may prefer to keep their real estate dealings discreet.

However, it’s important to note that non-disclosure doesn’t grant you the ability to hide essential property information. Sellers must fulfill their obligation to prospective buyers and disclose material defects along with other relevant details regarding the property’s condition in compliance with their state’s property condition disclosure requirements. Non-disclosure pertains specifically to the selling price and its exclusion from public records.

Challenges of Investing in a Real Estate Non-Disclosure State

One significant hurdle of real estate non-disclosure states is assessing market trends and property values. It becomes more difficult to compare similar properties and determine accurate valuations without access to actual transaction sale prices. Real estate professionals and investors must rely on alternative methods and sources of information to gauge market conditions in non-disclosure states.

Navigating a real estate transaction in a non-disclosure state requires a different approach. Real estate agents and appraisers are crucial in providing guidance, and utilizing their expertise to estimate property values effectively is essential.

Throughout the following sections, we’ll explore each of the 12 non-disclosure states in detail. Understanding the nuances of non-disclosure states equips you with the necessary tools to navigate real estate transactions, make informed decisions, and ensure a smooth process from start to finish. So, let’s dive into the intricacies of each state and uncover the impact of non-disclosure laws on real estate dealings.

The 12 Real Estate Non-Disclosure States:

Disclaimer: We gathered the information in this section from various sources, both online and offline. If you wish to explore the sources we used, we have provided links within each section. Please note that this section does not claim to be the authoritative answer on how each state operates. Instead, it represents our most educated assessment based on the information we were able to gather. If you have evidence to show that our assessment is incorrect in any particular state, feel free to contact me and point out any sources to support your claim.

1. Alaska

In 2019, the Juneau Empire reported that while five states still require the disclosure of transaction prices to the government, Alaska is not one of them. This makes property tax assessments challenging, making it important for those considering investing in Alaska to pay close attention to the tax assessment of their potential property to ensure fair taxation.

While there is no obligation to reveal sale prices, property sellers must complete a property condition disclosure. However, the disclosure can be waived if both the seller and buyer agree to it.

2. Idaho

In Idaho, the disclosure of sales prices is voluntary. A probe conducted by the Idaho Capital Sun revealed that the Intermountain Multiple Listing Service holds the most accurate database of sales records, providing valuable information for real estate transactions. If you need to determine after repair value or overall market value, it’s recommended to speak with a local real estate expert who can provide comparable sales data.

Although disclosure of sales prices are not required, under Idaho statute, a property condition disclosure is required.

3. Kansas

While sales prices are not disclosed in Kansas, working with a licensed real estate professional with access to the MLS can make performing due diligence easier. There are 12 local realtor boards in Kansas, each operating within its own jurisdiction.

So if you’re trying to gauge market trends and access average sales price data before committing to a real estate agent. The following local realtor boards publish market stats regularly:

- Kansas City Regional Association of Realtors

- Lawrence Board of Realtors

- Flint Hills Association of Realtors

- Realtors of South Central Kansas

- Sunflower Association of Realtors

As an alternative to MLS records, appraisers and real estate brokers will also have access to assessor data, including sales prices and factors that influenced the sale, by taking a trip to the assessor’s office.

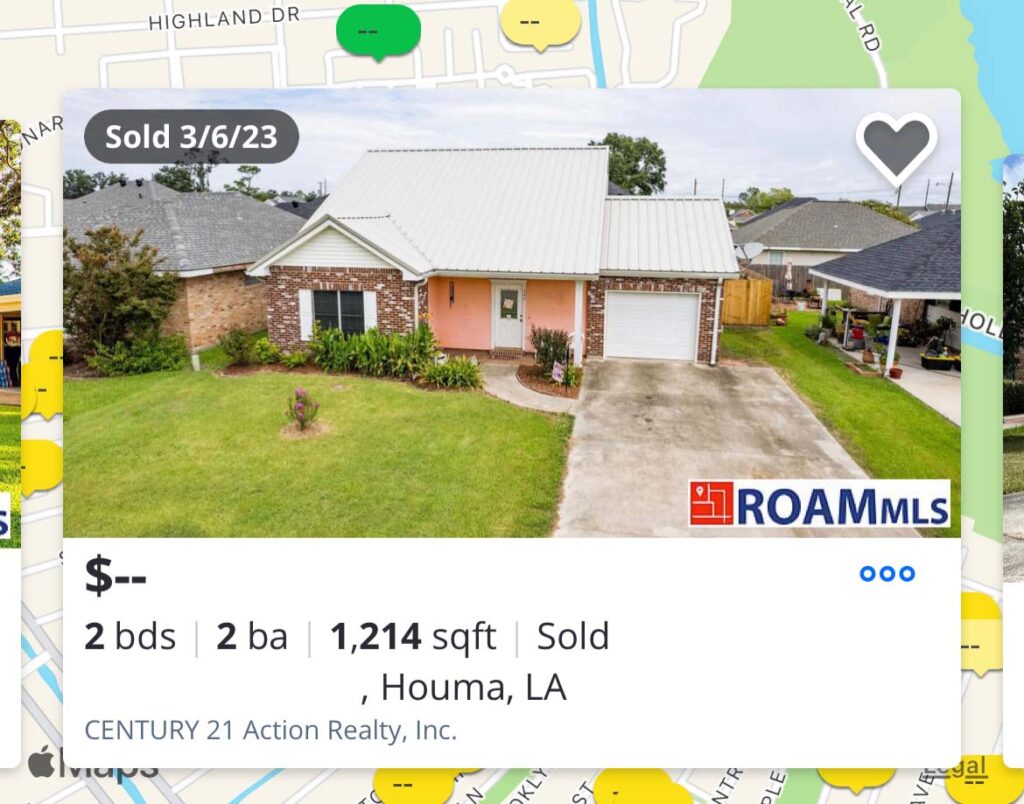

4. Louisiana

Partnering with an investor-friendly real estate professional with access to one of Louisiana’s many multiple listing services can enable you to perform due diligence, even though sales prices are not publicly disclosed in the State of Louisiana. There are currently ten local realtor board associations within the Louisiana Realtors Association.

So if you’re teetering with the idea of investing in Louisiana, the following local boards publish market stats specific to their jurisdiction regularly:

- Greater Central Louisiana Realtors Association

- Greater Baton Rouge Association of Realtors

- New Orleans Metropolitan Association of Realtors

5. Mississippi

Mississippi, home of the $10 deed (most deeds will have a consideration amount of $10 listed, not the actual sales price), is one of the most discreet states when it comes to property records. Not only are sales prices not disclosed, but none of the 20 local realtor board associations publish market statistics online either. Cultivating a relationship with a real estate professional in this state is necessary.

6. Missouri

Missouri operates as a hybrid state for real estate transactions, combining disclosure and non-disclosure practices. Some subdivisions, including St. Louis City, St. Louis County, Jackson County, and St. Charles County, require mandatory disclosure of sales prices.

7. Montana

In Montana, only multiple listing services (MLS) and government entities, such as county assessor offices, can access real estate sales prices. However, it’s important to note that these sales prices are not publicly available on websites like Zillow, Redfin, or Trulia. (No Zestimate’s for you!)

But, if you’re seeking general market data, these local realtor board associations provide updated market reports on a regular basis:

- Gallatin Association of Realtors

- Great Falls Association of Realtors

- Helena Association of Realtors

- Missoula Organization of Realtors

8. New Mexico

According to Ocean City Today‘s report, New Mexico is a strict non-disclosure state. The local city or county can only disclose information about a property that has been collected to the registered owner of the property.

9. North Dakota

Getting local real estate information in North Dakota can be challenging. Sales prices are not disclosed, and local realtor boards do not regularly post market statistics. Therefore, your best option for accessing the information needed to perform due diligence is to partner with a real estate agent or broker with access to MLS data.

10. Texas

In Texas, only realtors and appraisers have access to comparable sales. Working with a rockstar real estate professional who can provide comparable sales data from the MLS is the way to go. MLS rules require listing brokers to promptly report sales of listed property, including sales prices, to the MLS.

11. Utah

According to the Harvest Park Group, sales prices are not held as a public record in Utah. However, Utah is a unique case. Buyers can opt out of disclosing their sales price on the MLS for a $500 fee, making performing due diligence more challenging.

12. Wyoming

Although Wyoming is a non-disclosure state, MLS records are still the main source of sales data. If you’re interested in local market trends, take a look at these local realtor boards that provide frequently updated market statistics:

The Wrap Up

Investing in real estate in non-disclosure states can be tricky, so it’s important to understand the rules. Having a real estate agent or appraiser on your team is crucial since automated valuation models like Zillow’s Zestimate aren’t always reliable. While there may be challenges, there are also opportunities for those who are align themselves with like minded professionals and are prepared.

Frequently Asked Questions

There are 12 real estate non-disclosure states in the US.

Non-disclosure in real estate pertains specifically to the selling price. Real estate non-disclosure states operate under the premise that the selling price of a home should not be disclosed in public records.

Yes, even if a state is a non-disclosure state, a property condition disclosure may still be required. Non-disclosure generally only applies to sales prices. A property condition disclosure is a statement of known issues with a property.