Applying and qualifying for a DSCR loan can be a step in the right direction towards achieving your investment goals. In this article, we’ll guide you through the process and show you how to get a DSCR loan, providing simple and actionable steps to help you navigate the application process and increase your chances of qualifying.

Understanding DSCR Loans

When it comes to financing your real estate investments, it’s important to know about different loan options. Unlike regular conventional mortgages that mostly look at your personal income and credit, DSCR loans pay attention to the rental income your property can bring in. That means that even if you don’t have a high personal income or perfect credit, financing your investment property with a DSCR loan is still an option.

To figure out if you qualify for a DSCR loan, lenders use a metric called the Debt Service Coverage Ratio (DSCR). They compare the rental income from your property to the total expenses you have to pay, this includes your annual taxes, annual insurance and the projected mortgage debt you have to pay, including the principal and interest. The higher the DSCR, the better your chances of getting the loan. Lenders generally prefer a DSCR of at least 1.25.

In the next section, we’ll look at the important factors that decide whether you qualify for a DSCR loan. Knowing these factors will prepare you to take the next step towards getting the financing you need for your investment properties.

How to Get a DSCR Loan: The Application Process

The application that needs to be completed for a DSCR loan is fairly simple. You can expect to provide:

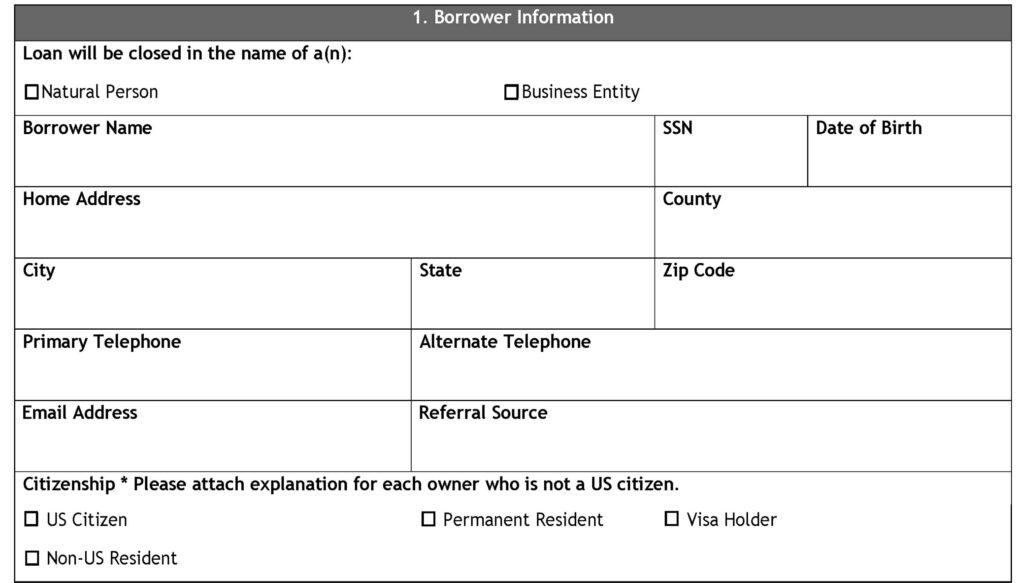

Borrower Information:

This will include your name, address, phone number and e-mail address.

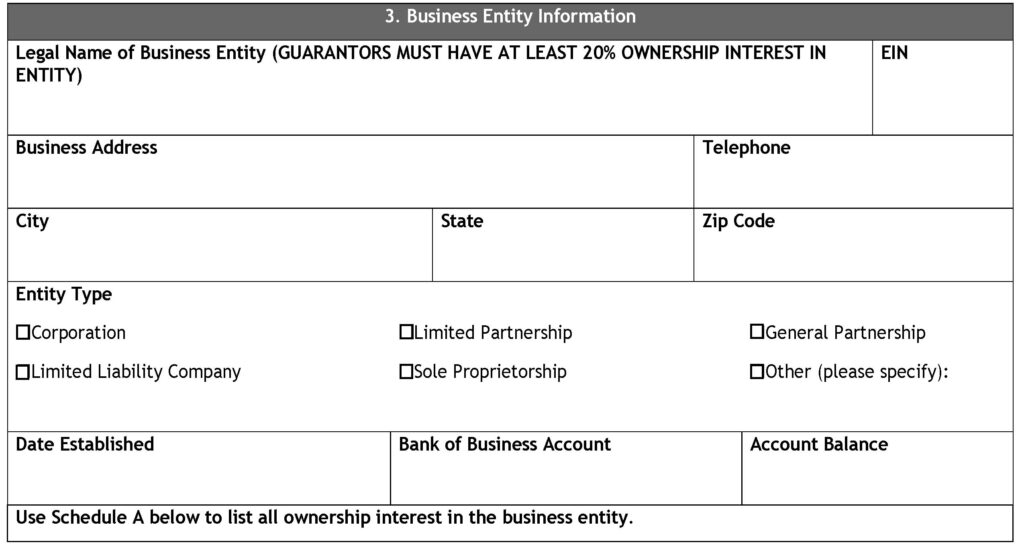

Business Entity Information:

Since DSCR loans are business purpose loans, they are typically made to business entities. In this section, you will provide your business name, the business EIN number, the business address, the entity type (LLC’s are most common) and the date the business was formed. If there are multiple members in the business you may need to provide each member’s share amount.

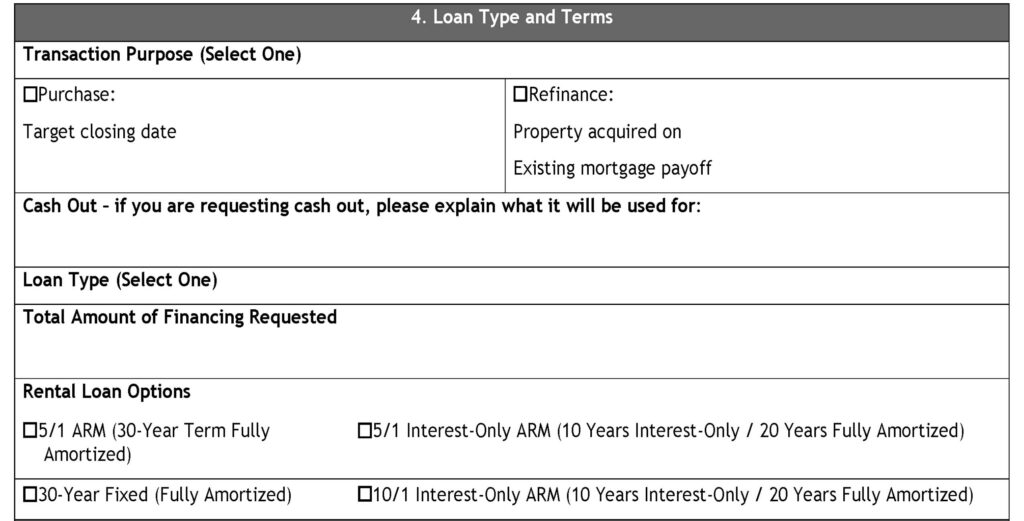

Loan Type and Terms:

In this section you will select the type of loan you are applying for (purchase or refinance), the loan amount requested and the desired terms.

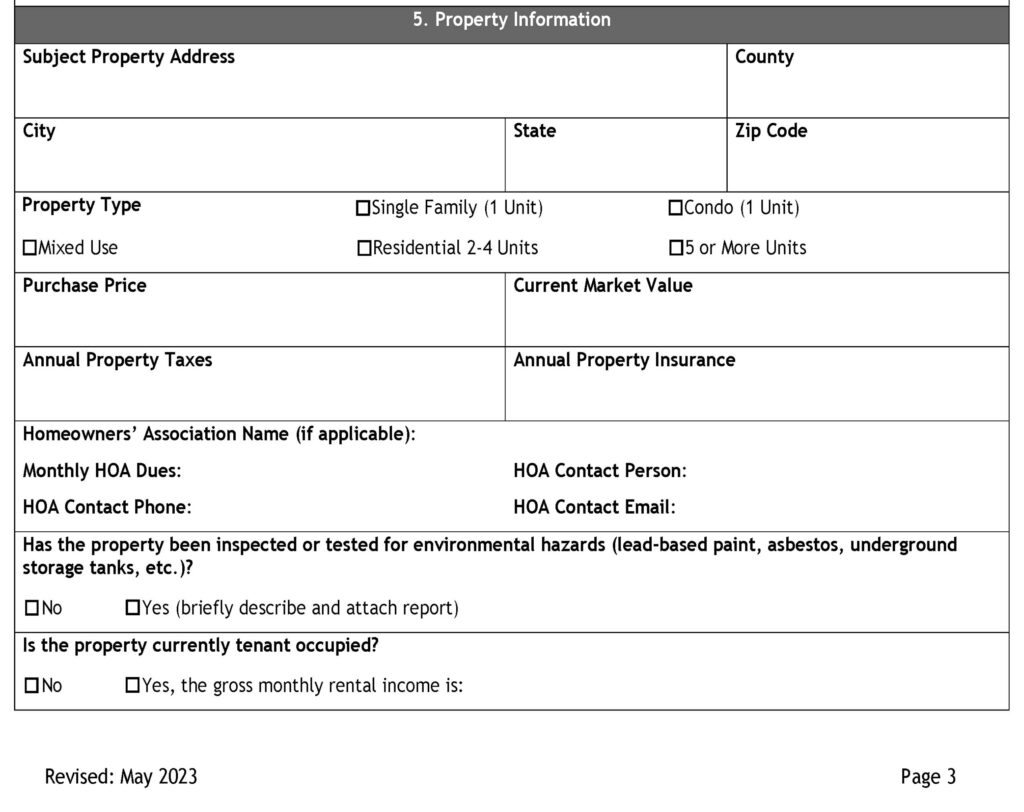

Property Information:

Here you will provide the address to the property you wish to finance along with the property type (single family, 2-4 unit, condo etc…)

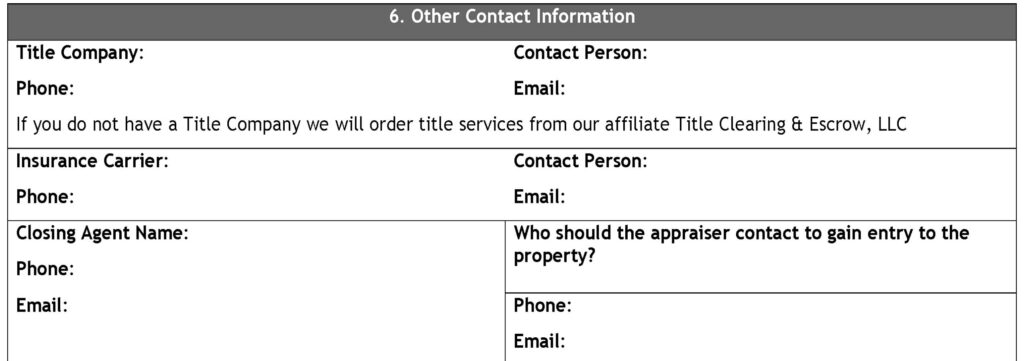

Other Contact Information:

To streamline the process, some application feature a section where you will include the contact information for your insurance agent and title company.

Credit Authorization:

Lastly, you can expect to sign a credit authorization to give the lender permission to access your credit report.

Assessing Your Eligibility For a DSCR Loan

Now that you understand the basics of DSCR loans and what to expect in a loan application, it’s time to figure out if you’re eligible to apply for one. Lenders consider a few important factors when deciding if you qualify, and we’re here to guide you through the process.

- Credit Score: Lenders typically look for a FICO score of at least 620.

- Debt Service Coverage Ratio: As mentioned earlier, the DSCR is a critical ratio that lenders use to evaluate your eligibility. This ratio shows how much rental income you have compared to the debt you need to pay. A higher DSCR is generally preferred by lenders because it means you have more income to cover your expenses. Aim for a DSCR of at least 1.25 for the best terms possible.

- Documentation: You’ll also need to gather some important documents to support your application. This may include tax returns, bank statements, rental leases, and property financials. Having these documents ready will make the application process quicker and smoother.

- Experience: Lastly, lenders may take into account your experience as a real estate investor. They want to see that you have some knowledge and success in managing rental properties. If you’re new to real estate investing, don’t worry! Everyone starts somewhere, and a DSCR loan may still be available for you.

Tips for DSCR Loan Approval

Now, lets dive into some helpful tips to increase your chances of approval and make the process easy!

Showcase Your Property’s Potential:

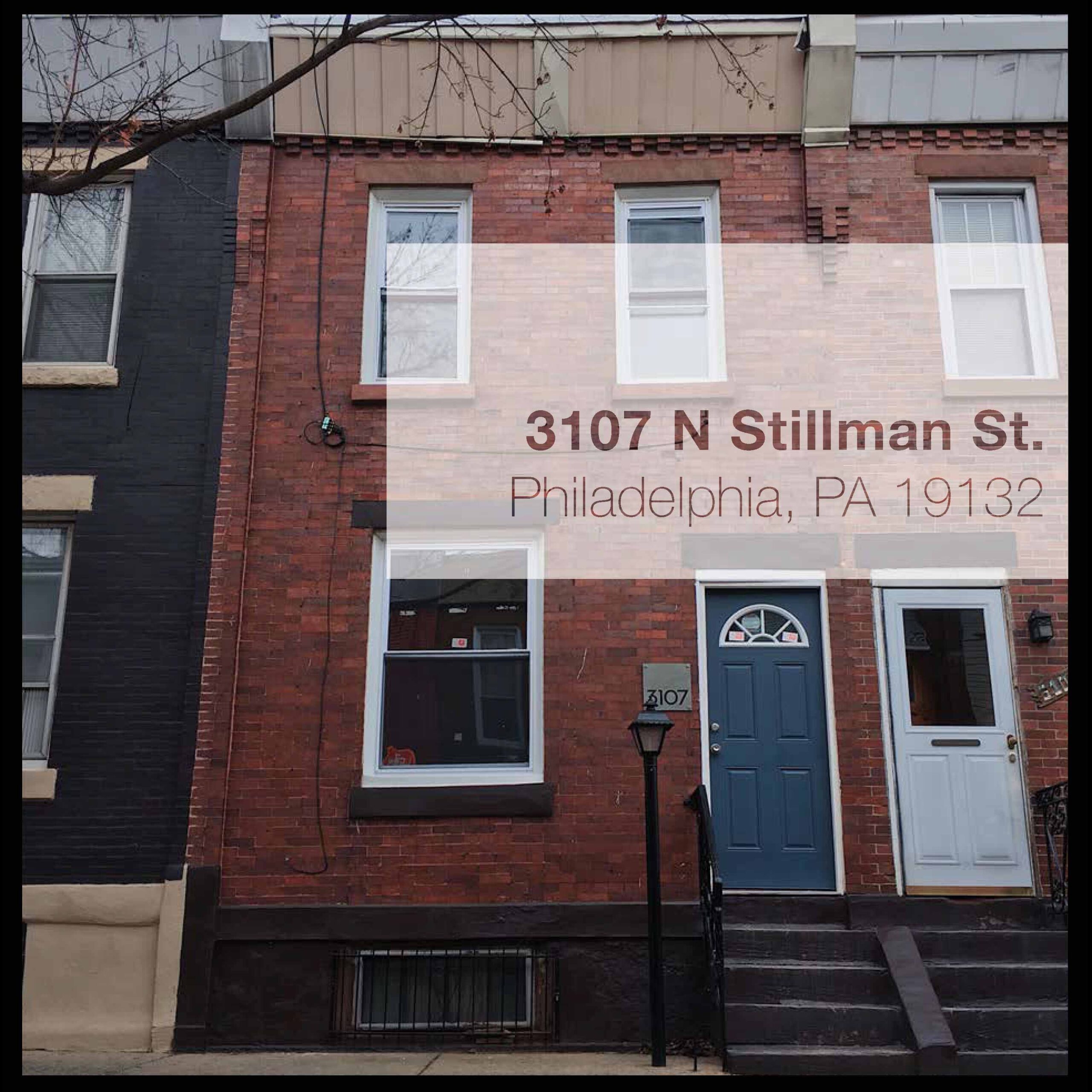

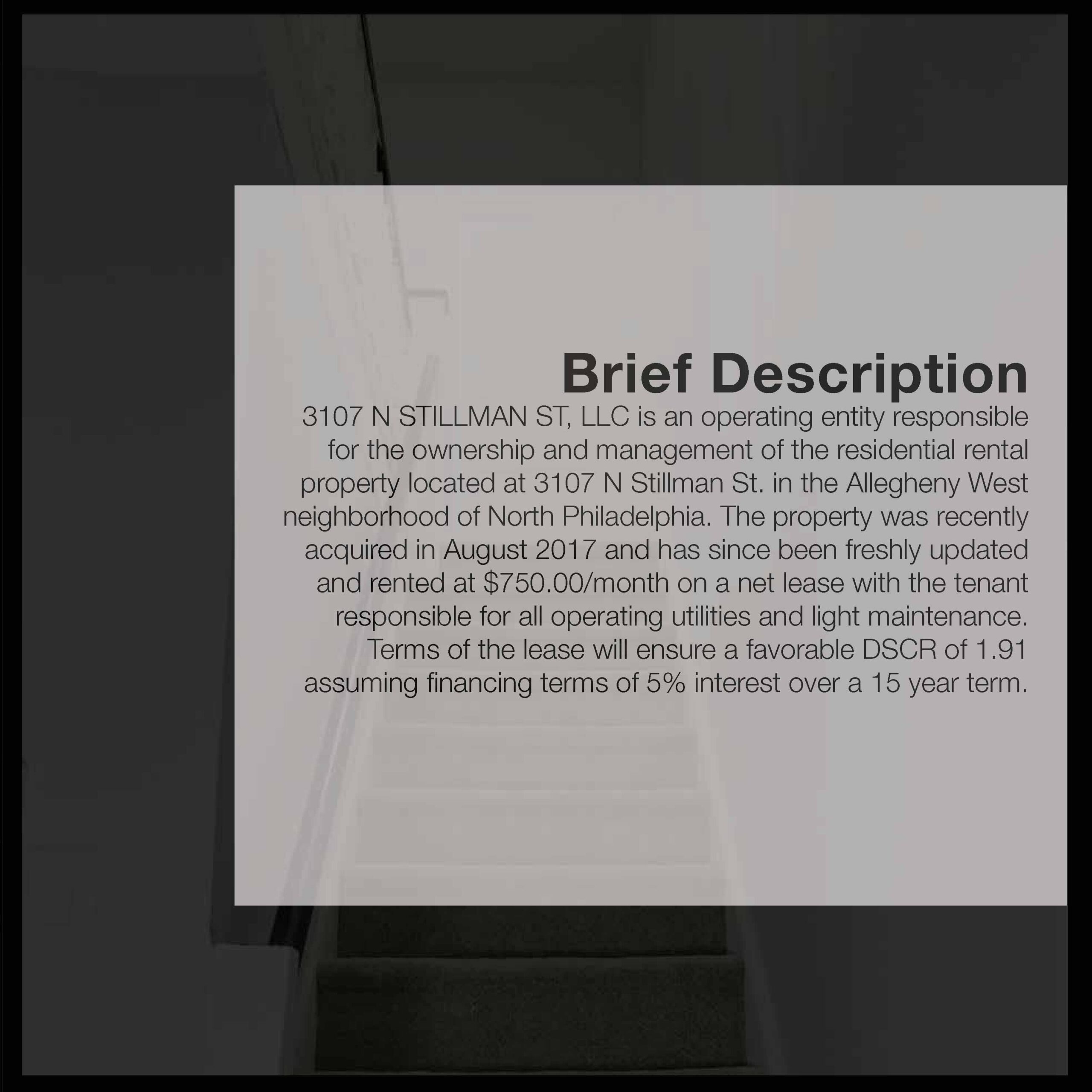

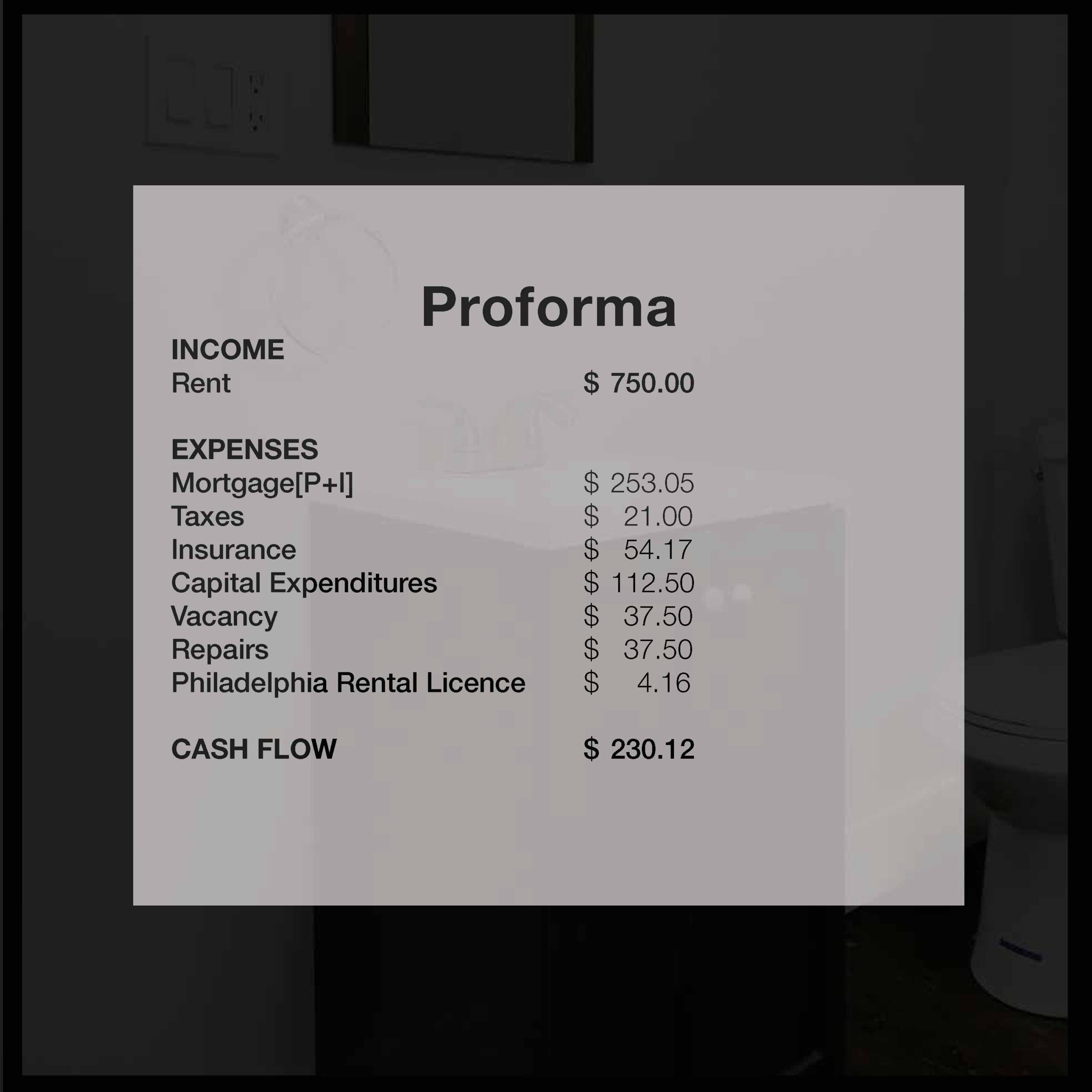

Creating a small PDF pamphlet that highlights the income-generating potential of your investment property can set you apart from the pack. Provide accurate and detailed information about the property’s rental income, expenses, and any improvements you’ve made. A splash of color can help break up the monotony of a loan officer’s day. Check out an example that was put together for a cash-out refinance:

Build Relationships:

Cultivate positive relationships with lenders and mortgage brokers who specialize in DSCR loans. They have experience working with real estate investors and can provide valuable guidance throughout the process. Building these relationships can open doors to more financing opportunities in the future.

Communicate Clearly:

Be open and transparent. Clearly explain your investment goals, plans for the property, and any challenges you anticipate. Sharing this information helps lenders understand your vision and increases their confidence in your ability to succeed.

How to Get a DSCR Loan: The Next Step

In conclusion, I’ve covered the basics, the application process, eligibility requirements, and helpful tips. Now, it’s time to encourage you to move forward and pursue your real estate goals.

- Reflect on Your Real Estate Vision: Take a moment to reflect on your real estate vision and the goals you’ve set for yourself. Whether it’s growing your rental property portfolio, renovating properties, or diversifying your investment strategy, a DSCR loan can be a powerful tool to support your aspirations.

- Connect with a Trusted Mortgage Broker: Reach out to a trusted mortgage broker who specializes in DSCR loans. They have the expertise and industry connections to guide you through the process and help you find the best loan options tailored to your needs. A reliable broker can be your advocate, saving you time and simplifying the loan search.

- Gather Your Documentation: Start gathering the necessary documentation for your loan application. As we discussed earlier, this may include tax returns, bank statements, property details, and rental income information. Having these documents ready will streamline the application process and demonstrate your preparedness.

- Stay Engaged and Responsive: Throughout the loan process, it’s essential to stay engaged and responsive to any requests or inquiries from your lender. Promptly provide any additional information or documentation they may need. By being proactive, you’ll help expedite the approval process and demonstrate your commitment.

- Celebrate Your Success: Finally, celebrate each milestone along the way. Whether it’s getting pre-approved, receiving a loan offer, or closing on your loan, each step is a significant achievement on your real estate journey. Take pride in your accomplishments and keep moving forward with determination.

I hope this guide has provided you with valuable insights and confidence to pursue a DSCR loan. Remember, you’re not alone on this journey. Reach out to our team at Refi Simply if you have any questions or need assistance. We’re here to help you make your real estate investment goals a reality.