When it comes to financing your real estate investments, Debt Service Coverage Ratio (DSCR) loans are an option worth considering. Especially when growing your rental property portfolio! In this article, I’ll dive into the pros and cons of DSCR loans, providing you with valuable insights that will help you make an informed decision with your investment ventures. Whether you’re a seasoned investor or a an ambitious real estate rookie, understanding the pros and cons of DSCR loans along with basic DSCR loan requirements will help you navigate the world of real estate financing more effectively and confidently.

What Are DSCR Loans?

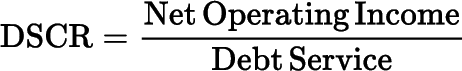

DSCR loans cater specifically to real estate investors. Unlike traditional loans, which heavily depend on your income, personal DTI (debt-to-income) ratio, and creditworthiness (credit score) to finance an investment property. DSCR loans undergo underwriting based on the property’s income generation potential not your personal income. When calculating DSCR, Lenders take your property’s net operating income (NOI) and divide it by your operating expenses (taxes, insurance, and projected annual mortgage payments) to determine your ability to cover loan payments using the property’s cash flow. A good dscr ratio typically is around 1.25, however, we’ve seen lenders approve loans with a low DSCR.

(example of DSCR formula)

The Pros of DSCR Loans

DSCR loans offer several benefits for real estate investors. Aside from the typical high LTV (loan-to-value) cash-out refinance abilities and an application process that’s arguably a million times easier than those of conventional lending financial institutions. A DSCR loan offers:

Ability to Scale:

With conventional financing, there’s typically a maximum limit of 10 conventional loans that you can obtain. However, most conventional borrowers tend to tap out at around 4-5 loans due high DTI ratios that prevent the borrower’s ability to qualify for anymore conventional loans.

Since a DSCR loan is considered a business purpose loan, and is usually made to an entity like an LLC, there is technically no limit to how many loans you can acquire. As long as the subject property meets the lenders’ eligibility requirements. A DSCR mortgage is not out of reach.

Easier Approval:

As I mentioned before, DSCR loans undergo underwriting based on a property’s cash flow. This translates into an easier loan approval process. To have a DSCR loan approved, you typically need to provide:

- a bank statement as proof of funds to close,

- latest tax returns (although not always required),

- have an appraisal of the property completed,

- and provide a tenant lease.

In some cases, if the property is vacant, the rent amount can be derived from the appraisal report based on the appraiser’s assessment of market rent in your property’s market area.

Flexibility:

DSCR loans are a good option for various real estate investments, including short-term rentals like Airbnb or VRBO, condos (if allowed by the HOA), single-family units, multi-family units, mixed-use buildings, and commercial real estate. This flexibility empowers you to diversify your portfolio by using your positive cash flow to approve your loan. Provided that there is enough income to cover the subject property’s current debt obligations including the monthly payment (principal and interest payments).

The Cons of DSCR Loans

While DSCR loans provide advantages, it’s crucial to be aware of the potential drawbacks. Although the minimum credit score requirements are more flexible (usually a minimum 620 FICO is required). Down payment requirements can be higher if a particular lender has a minimum DSCR requirement that needs to be met for approval. In addition to the possiblity of higher fees (we hate them too!), a debt service coverage ratio loan (DSCR) may have:

Higher Interest Rates:

DSCR loan interest rates can produce sticker shock for some investors. Especially for those investors who are used to the lower interest rates associated with conventional mortgage loan products. Naturally, DSCR loans are higher risk for the lender so they may come with an interest rate that is 1-3% higher than those of conventional mortgages. This is due to the fact that the spotlight shifts from scrutinizing your personal financial history to analyzing whether or not your property has the ability to reliably have its net operating income (gross rental income minus operating expenses) cover the total debt service (fancy for mortgage payment) and have a little cha-ching leftover for you.

Personal Guarantee Required:

Although a DSCR loan is made to an entity like an LLC, members of that entity with a majority stake in the company will likely be required to personally guarantee the loan. Generally, members with more than a 25% ownership listed on the loan application will be subject to lender review. However, even though a personal guarantee is required, you should not expect the loan to report to your personal credit report.

Potential cash flow risks:

If you decide to go with an adjustable rate DSCR loan, fluctuations in interest rates, rental income or occupancy rates (or a perfect storm of all three – ask me how I know!) can impact your ability to meet debt service requirements. It’s important to account for potential risks and have a contingency plan in place should the tides shift in the future.

Mitigating Risks and Maximizing Benefits

To mitigate risks and maximize the benefits of DSCR loans, I would strongly consider the following strategies:

Establish a Contingency Plan:

I know we just touched on this but, it is worth mentioning again. Creating a backup plan to handle potential cash flow disruptions is important! Vacancies and evictions happen. Having reserves or alternative income streams can help ensure you meet your debt service requirements, even during challenging times.

Conduct Thorough Due Diligence:

Before securing a DSCR loan, analyze the property’s income potential and projected cash flow. Are those rents only great on paper? Is your property under-assessed and due for a significant tax increase in the future? Proper due diligence will ensure that your investing experience is optimal.

Build Strong Relationships:

Your success in real estate is heavily dependent on the relationships you establish. Aside from working with a rockstar mortgage broker, work on building solid relationships with contractors, real estate agents, insurance agents and property managers if you desire to truly scale your real estate portfolio.

The Wrap Up

DSCR loans offer advantages such as the ability to scale your portfolio, an easier approval process, and flexibility in property types, making a DSCR loan an attractive financing option for real estate investors who just might not tick off all of the boxes of a conventional lender. However, it’s crucial to consider the potential drawbacks, including higher interest rates, personal guarantee requirements and potential cash flow risks. By establishing contingency plans, conducting thorough due diligence and building strong relationships with lenders you can mitigate risks and maximize the benefits of a DSCR loan. Got any questions? Don’t hesitate to reach out to us. We’d love to help!