One commonly used method, especially for new constructions or unique properties, is the Cost Approach. The Cost Approach is used to determine how much a property is worth by calculating how much it would cost to build a similar one today. This cost is then adjusted by adding the land value and subtracting any loss in value (depreciation) due to age or wear and tear (if warranted).

This article aims to provide a comprehensive guide to the Cost Approach, its applications, pros and cons, and how it compares to other valuation methods. Let’s get to it!

What is the Cost Approach?

The Cost Approach is a popular method for determining the value of a property. It is beneficial for new constructions or unique buildings. In simple terms, it calculates how much it would cost to build a similar property today, then adjusts that amount by adding the value of the land and subtracting any loss in value due to things like age or needed repairs.

According to the Appraisal Institute, the Cost Approach is:

“a set of procedures through which a value indication is derived for the fee simple interest in a property by estimating the current cost to construct a reproduction of, or replacements for, the existing structure; deducting depreciation from the total cost; and adding the estimated land value. Other adjustments may then be made to reflect the value of the property interest being appraised.”

This approach breaks down the property into its essential components:

- the land,

- the building structure and,

- any depreciation or wear and tear.

By understanding these elements, real estate investors and homeowners can gain a clearer picture of a property’s worth, making it easier to make informed decisions whether you’re buying, selling, or evaluating an asset.

Related: How to Read an Appraisal

When to Use the Cost Approach

Knowing when to use the Cost Approach can be as important as understanding how it works. This valuation method is advantageous in specific scenarios:

New Construction

The Cost Approach is often considered the most accurate for new buildings. Since the construction costs and land value are known or can be accurately estimated, this method provides a reliable valuation.

Unique Properties

The Cost Approach can be invaluable for unique properties or with few comparables. This includes specialized commercial properties like factories or custom-built homes.

Insurance Valuations

When determining a property’s insured value, the Cost Approach can be helpful because it considers the cost of rebuilding the structure from scratch.

Limited or No Market Activity

In areas with limited market activity or sales data, the Cost Approach can offer an alternative way to estimate property value.

When Not to Use the Cost Approach

While the Cost Approach has its merits, it’s not always the best choice. For instance, it may not be ideal for older properties where the cost of reproducing the existing structure may not accurately reflect its market value. Similarly, it might not capture the nuances of a hot real estate market where prices are driven more by demand than construction costs.

Now, let’s look at the formula used to determine the value of a property using this approach.

The Cost Approach Formula

The basic formula for the Cost Approach can be summarized as follows:

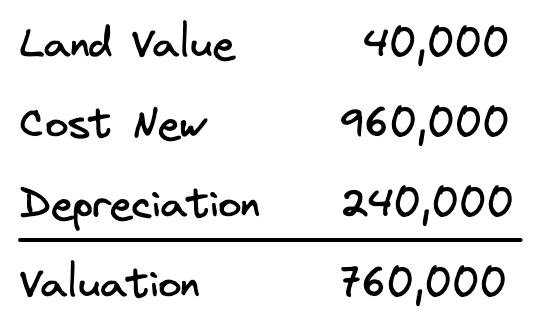

Property Value = Land Value + Cost of Construction – Depreciation

Land Value

The first component is the value of the land as if it were vacant and available for use. This is often determined through the Sales Comparison Approach, where the prices of similar land parcels are compared.

Cost of Construction

This is the estimated cost to build a new structure that is identical or similar to the existing one on the property. This cost includes materials, labor, overhead, and even a profit margin for the builder.

Depreciation

Depreciation accounts for any loss in value due to factors like age, wear and tear, or functional obsolescence. Essentially, it’s the amount by which the new building loses value when compared to the existing structure.

Real-World Example of the Cost Approach

To better understand the Cost Approach, let’s walk through a real-world example featuring Delia, a real estate investor interested in purchasing a unique property for investment purposes.

The Property

Delia has her eyes on a custom-built home in a suburban area. The property is unique, making it challenging to find comparable sales data. She decides to use the Cost Approach to estimate its value.

Land Value

After some research, Delia finds that similar land parcels in the area have sold for around $100,000. She uses this as the estimated land value.

Cost of Construction

Delia consults with construction experts and decides to use the Marshall and Swift Cost Manual, a widely recognized source for construction costs, to produce an accurate estimate. According to the manual, it would cost around $200,000 to build a similar custom home, including materials, labor, and a profit margin for the builder.

Depreciation

The existing home is ten years old and shows some signs of wear and tear. After consulting with a property inspector, Delia estimates a depreciation value of $20,000.

Applying the Formula

Using the Cost Approach formula, Delia calculates the property value as follows:

Property Value = Land Value + Cost of Construction – Depreciation

Property Value = $100,000 (Land Value) + $200,000 (Cost of Construction) – $20,000 (Depreciation)

Based on this calculation, Delia estimates the property to be worth $280,000. This gives her a solid basis for negotiating the purchase price.

Pros of the Cost Approach

Here are some of the key benefits:

Accuracy for New Constructions

The Cost Approach is often the most accurate method for valuing new constructions. Since all the components—land value, construction costs, and depreciation—are either known or can be accurately estimated, this method provides a reliable valuation.

Useful for Unique Properties

The Cost Approach offers a way to estimate value that other methods may not provide for properties that are one-of-a-kind or have few comparables.

Detailed Breakdown

The Cost Approach offers a detailed breakdown of the different components of a property, from land value to construction costs and depreciation. This can be particularly useful for investors who want a deep understanding of their potential investment.

Versatility

While particularly useful for certain properties, the Cost Approach can also be adapted for various kinds of real estate, from residential to commercial and industrial properties.

Cons of the Cost Approach

While the Cost Approach has several advantages, it’s essential to consider its limitations. Here are some of the drawbacks:

May Not Reflect Market Conditions

The Cost Approach focuses on the cost of building a similar property. Still, it may not always capture the current market conditions. For example, in a hot real estate market, properties might sell for more than it would cost to build them.

Time-Consuming and Potentially Costly

Gathering all the necessary data for the Cost Approach, such as construction costs from sources like the Marshall and Swift Cost Manual, can be time-consuming. Additionally, you may need to consult with experts, which can add to the cost.

Less Accurate for Older Properties

The Cost Approach may not provide the most accurate valuation for older properties where the structure has undergone significant wear and tear or modifications.

Complexity

The Cost Approach involves various calculations and adjustments, which can be complex and may require a deep understanding of construction costs, depreciation, and other factors.

Cost Approach vs. Sales Comparison Approach

Regarding real estate valuation, the Cost Approach is just one of several methods available. Another commonly used method is the Sales Comparison Approach. Understanding the differences can help you choose the most appropriate method for your needs.

Basis of Valuation

- Cost Approach: Focuses on the cost to build a similar property, adjusted for land value and depreciation.

- Sales Comparison Approach: Compare the property to similar properties recently sold in the area.

Best Use Cases

- Cost Approach: Ideal for new constructions, unique properties, or limited market activity.

- Sales Comparison Approach: Best for properties in active markets with plenty of comparable sales data.

Data Required

- Cost Approach: Requires detailed information on construction costs, land value, and depreciation.

- Sales Comparison Approach: Requires sales data of comparable properties.

Market Sensitivity

- Cost Approach: This may only partially capture current market conditions.

- Sales Comparison Approach: Highly sensitive to market conditions and provides a market-driven value.

Complexity

- Cost Approach: This can be complex and time-consuming, requiring various calculations and potentially expert consultation.

- Sales Comparison Approach: It is generally more straightforward and quicker, relying on existing market data.

Cost Approach vs. Income Approach

Another important valuation method to consider, especially for investment properties, is the Income Approach. Here’s how it compares to the Cost Approach:

Basis of Valuation

- Cost Approach: Estimates the value based on the cost of constructing a similar property, adjusted for land value and depreciation.

- Income Approach: Estimates the value based on the income the property is expected to generate.

Best Use Cases

- Cost Approach: Well-suited for new constructions, unique properties, or areas with limited market activity.

- Income Approach: Ideal for income-generating properties like apartment complexes, commercial buildings, or rental homes.

Data Required

- Cost Approach: Requires detailed data on construction costs, land value, and depreciation.

- Income Approach: Requires data on potential income, operating expenses, and capitalization rates.

Market Sensitivity

- Cost Approach: Sensitive to factors like rising construction costs.

- Income Approach: Sensitive to market factors that affect income, such as occupancy rates and rental prices.

Complexity

- Cost Approach: This can be complex due to the need for various calculations and adjustments.

- Income Approach: Complexity varies but generally requires a deep understanding of financial metrics and market factors.

Cost Approach and New Construction

One of the scenarios where the Cost Approach shines is in the valuation of new construction. Here’s why this method is beneficial for newly built properties:

Accurate Construction Costs

The actual construction costs are often known for new constructions, making the Cost Approach highly accurate. Using reliable sources like the Marshall and Swift Cost Manual can further refine these estimates.

Minimal Depreciation

Newly built properties have little to no depreciation, simplifying the calculation and making the valuation more straightforward.

Land Value

The value of the land is usually a known factor in new constructions, especially if the property was recently developed. This adds another layer of accuracy to the Cost Approach.

Investment Decisions

For real estate investors eyeing new construction projects, the Cost Approach can provide a detailed breakdown of costs, helping to assess the viability and potential profitability of the investment.

Insurance Purposes

For new constructions, insurance companies often prefer the Cost Approach as it provides a clear estimate of the structure’s replacement cost.

Frequently Asked Questions

This section addresses some of the most commonly asked questions about the Cost Approach to help clarify any uncertainties you may have.

The accuracy of the Cost Approach can vary depending on the type of property and the quality of the data used. It is generally considered highly accurate for new constructions but may be less so for older or unique properties.

Yes, you can use the Cost Approach for older properties, but there may be more accurate methods. Depreciation and changes over time can make estimating the current construction cost challenging.

Land value is a critical component of the Cost Approach. It represents the value of the land if it were vacant and is added to the cost of construction to arrive at the total property value.

Reliable sources like the Marshall and Swift Cost Manual are commonly used to estimate construction costs accurately. Consulting with construction experts can also provide valuable insights.

The Cost Approach can be used for various real estate types, including commercial properties. However, the Income Approach may often be more appropriate for income-generating commercial properties.

The Wrap Up

In the landscape of real estate valuation, the Cost Approach is a versatile and detailed method for estimating property value, especially new construction homes.

Key Takeaways

- The Cost Approach is particularly useful for new constructions and unique properties.

- It provides a detailed breakdown of property components, aiding in more informed investment decisions.

- While it has its pros, the Cost Approach also has limitations, such as potentially not reflecting current market conditions.

- The Cost Approach is one of several valuation methods. It should be considered alongside the Sales Comparison and Income Approaches for a comprehensive valuation.